“Transitory” Inflation is Proving Stubbornly Persistent

November 15, 2021

The Federal Reserve (Fed) and Biden Administration cautioned earlier this year that rising inflation was to be expected and that it was transitory in nature. While they did not choose to provide guidance for what constitutes a transitory period, it is, by definition, not to be thought of as permanent. As the months and quarters tick by, it is clear the inflation we are experiencing extends beyond a purely transitory rebasing of prices and disrupted supply chain phenomenon.

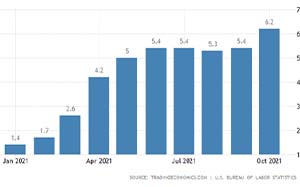

This past week, inflation in the month of October was measured at the highest level in 50 years, at 6.2% year‐over‐year.

Mohamed El‐Erian, chief economic advisor at Allianz, views the Fed as losing credibility on inflation and recently stated: “We have ample evidence that there are behavioral changes going on. Companies are charging higher prices [and] there’s more to come. Supply disruptions are lasting for a lot longer than anybody anticipated. Consumers are advancing purchases in order to avoid problems down the road — that of course puts pressure on inflation. And then wage behaviors are changing.”

Bad News on Inflation

Agreeing with El‐Erian’s sentiment is Scott Brown, Chief Economist at Raymond James, who succinctly shared the following this past week:

“October inflation figures were higher than expected. More troublesome, the range of items with higher inflation, relatively narrow in the spring, appears to be widening. Inflation expectations for the next five years have risen. Higher inflation is dampening consumer sentiment. The University of Michigan measures hit a decade low early November (but that doesn’t appear to be hurting household spending). Supply chain difficulties should clear up over time, but it may be a while.”

Cash and fixed income investments were already under pressure with little room to hold value after inflation coming into the COVID‐19 pandemic. Now, with yields compressed further and inflation higher, cash and safe bonds are almost certain to lose purchasing power until rates increase and inflation moderates.

Inflation’s Silver Lining

While the near‐term inflation outlook continues to trend higher than the Fed and Biden Administration’s guidance, Brown notes that “longer‐term inflation expectations remain moderate, reflecting the view that the Fed will act if inflation doesn’t fall back [to target levels] on its own.”

Fortunately, equities have continued to perform well, with risky portfolios outperforming inflation and growing purchasing power this year. Further, home and real estate prices are up, as are the value of most risky assets. All of this coalesces into a significant lift in wealth, all else equal.

What is Next?

The Fed and Biden Administration continue to urge patience to see if recent price levels will moderate without the need to increase key interest rates to cool an overheating economy. However, most are losing patience with the “wait and see” approach.

We are seeing a flight from cash and high‐quality bonds, as investors look to improve yield on reserves. Unfortunately, in the current low‐yield environment there is no silver bullet – some form of risk is needed to seek historically palatable returns.

The bond markets have already priced in a persistently elevated level. After laboring to hit 2% inflation for the better part of a decade, breakeven rates between various Treasury bond instruments indicate investor sentiment of ~3%/year inflation for the next five years.

The bond markets appear less confident than the Fed’s posture with futures markets on interest rates suggesting a 60% chance of rate hikes in June 2022. This is a much stronger, and earlier sentiment.

Conclusion

In conclusion, inflation is showing itself to be resilient, and increasingly widespread. If this continues, expectations are for interest rate increases in mid‐2022. The next few months will likely be chaotic with natural seasonality to consumer demand over the Holidays, inflamed this year with supply chain disruptions that have not been worked through yet.

As always, we welcome any questions you may have and are happy to more specifically discuss how we view inflation impacting you, your portfolio, and your financial plan.

About the Author

Casey Kupper, CFP®, CFA, CAIA® is one of a small group of professionals with both their CERTIFIED FINANCIAL PLANNER™ certification and Chartered Financial Analyst (CFA) marks. As a principle at Cadent Capital, he is dedicated to helping each client build a better future by making better decisions today. He understands wealth management is a journey, and each step is an opportunity to make an impactful decision on accumulating, investing, and sustaining your wealth. If you need help developing a plan that will guide your journey, call our office at (972) 777-4991 or visit our website.

Disclaimer: Any opinions expressed are those of the author and not necessarily those of RJFS or Raymond James. There is no assurance that any of the trends mentioned will continue or forecasts will occur. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk regardless of the strategy selected. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the US stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investors’ results will vary. Past performance does not guarantee future results. You should discuss any tax or legal matters with the appropriate professional.