The “IT” Factor

May 4, 2021

A little over a year ago, just before COVID-19 was coming into focus, the economy and stock market seemed to have the “IT” factor. The global economy was improving, trending toward synchronous growth. Unemployment rates, inflation levels, interest rates and taxes were historically low – at least by modern standards. By most measures, the early 2020 economy and stock market could do no wrong. They had a certain je ne sais quoi that was hard to put a finger on, but it was undeniably working…you could say it had the IT factor.

This past NFL season was capped with a storied run by a storied quarterback in a storied career as Tom Brady led his second franchise to a win in “The Big Game” at the age of 43. Born only 3 weeks apart, I don’t like to think of Tom as old, but he is truly ancient among high-performing NFL quarterbacks. Among his peers, he isn’t especially physically gifted. During his career he hasn’t enjoyed great continuity with his key teammates. Now that he won without Bill Belichick on his sideline, the notion the unique pair was what made them so special is at least partly debunked. I think at this point the easiest thing to point toward to attempt explaining Tom Brady’s greatness and success is to simply say he has the IT factor.

If I were to ask you about the economy today, or the stock market since the pandemic began, and certainly the prospects of both going forward, many would conjure thoughts of another IT factor.

However, in this case IT is more in line with Stephen King’s 1986 horror novel, “It.” Without giving away too many spoilers on the 35-year-old tale, the villain in “It”, Pennywise, preys on the fears of his would-be victims. Today, if someone is concerned about a stock market crash, hyper-inflation, the erosion of the United States of America’s (US) place as leader of the global economy and free-world, it is not difficult to find reasons that support the concern. Two of the common themes we are hearing questions on are inflation and taxes. While rising inflation and taxes can absolutely have a greatly negative impact on the economy and stock market, in this letter, I want to share a perspective that maybe they aren’t quite so scary after all.

INFLATION

In mid-April, Bureau of Labor and Statistics released March end inflation data that had year-over-year increase of 2.6%. This was up materially from 1.2%, 1.4%, and 1.7% in December, January and February respectively.

We don’t need to read or watch the news to feel the effects of inflation. While inflation has not been broad, it has been sharp in a few key areas and pervasive enough to be a very real factor.

As most are aware, energy (including gas), has spiked in recent months. Additionally, anyone that has recently shopped for a vehicle or undertaken a home remodel has likely experienced high cost of materials and limited supply of inventory. While not as dramatic, food costs are also up year-over-year, an impact to virtually everyone.

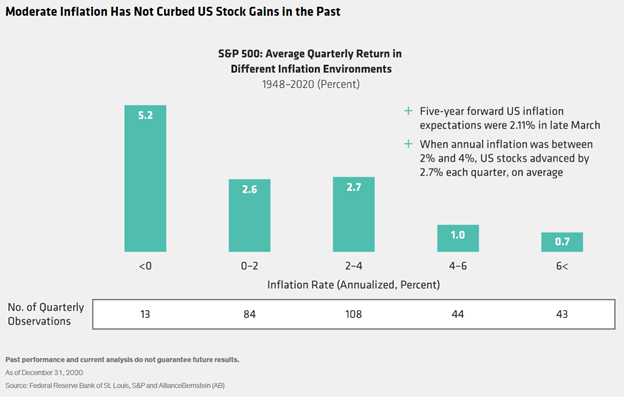

Research from The Federal Reserve Bank of St Louis, S&P, and Alliance Bernstein (below) shows that over the past ~70 years, there has been no observable difference in average quarterly stock market return as we move from low inflation of 0-2% inflation to a quicker paced inflation of 2-4%.

TAXES

In the midst of historic levels of stimulus and Federal budget deficits, coupled with the Biden Administration’s commitment to broadening and strengthening social programs, higher taxes appear inevitable. In fact, just this past week, the Biden administration put forth more details on its proposed tax changes in the $1.8T American Families Plan. While this is just an opening salvo on negotiations through the House and Senate, embedded are substantial proposed increases to corporate and personal tax rates and they are quite attention grabbing.

Without question, tax increases reduce cash flow for those impacted by the higher tax cost. It is easy to extend that negative cash-flow impact to businesses or families to less money available in the economy and the stock market. However, these impacts are not happening in a vacuum and I think it is important to make a distinction between what is negative for an individual, family or business’ cash flow, and what is negative for the stock market.

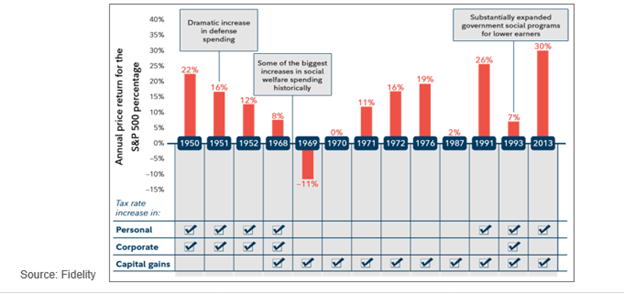

Since 1950, there have been 13 major tax hikes in the US, shown below:

During the ensuing 12 months, the S&P 500 experienced a positive return 11 times with another being flat. Only following the 1969 tax hike was the market negative, down 11%. In that lone down year, there were both fiscal and monetary tightening during a period GDP was declining, neither of which is present at this time.

EXCESS

While elevated inflation and tax rates may not slow the economy and market in the near-term, there are natural limits to how high they can go before they risk becoming a negative impact. History has shown corporate tax rates in the upper 20s to low 30s (%) is the limit before further tax increases begin to decrease tax revenue, hopefully putting a natural ceiling on how high corporate tax rates can reasonably move as the tax plan progresses toward tax law.

Jamie Dimon, CEO of JPMorgan Chase, has cited current economic conditions potentially being conducive for a “Goldilocks economy” to emerge and persist. As you might infer from the children’s fairy tale, a Goldilocks economy isn’t growing too fast, avoiding the need for the Federal Reserve to attempt to slow the economy (i.e., to raise interest rates). It also isn’t too slow, with enough growth to avoid a recession. In essence, conditions are just right for steady economic growth, and for stock markets to do well.

It is easy to see higher inflation and higher taxes as an economic cost. For those living off of a fixed income, that is largely true, having a negative impact on disposable income (reduced by higher taxes) and standard of living (reduced by inflation over time).

This letter is filled with many facts, a few opinions, and a lot of economic theory; enough to possibly moonlight as a sleeping pill on a sleepless night. To summarize playfully, I’ll leave you with this haiku:

Inflation may stay

Tax hikes loom, we should know soon

Stocks, they can still bloom

About the Author

Casey Kupper, CFP®, CFA, CAIA® is one of a small group of professionals with both their CERTIFIED FINANCIAL PLANNER™ certification and Chartered Financial Analyst (CFA) marks. As a principle at Cadent Capital, he is dedicated to helping each client build a better future by making better decisions today. He understands wealth management is a journey, and each step is an opportunity to make an impactful decision on accumulating, investing, and sustaining your wealth. If you need help developing a plan that will guide your journey, call our office at (972) 777-4991 or visit our website.

Disclaimer: Any opinions expressed are those of the author and not necessarily those of RJFS or Raymond James. There is no assurance that any of the trends mentioned will continue or forecasts will occur. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk regardless of the strategy selected. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the US stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investors’ results will vary. Past performance does not guarantee future results. You should discuss any tax or legal matters with the appropriate professional.